Irs Schedule 2 2024 Line 6 – This tax season, the IRS said it’s adding staff and technology to “reverse the historic low audit rates” on high-income taxpayers. Filing season can already be a stressful time for many people, with . It comes to 15.3% of net self-employment income (12.4% for Social Security and 2.9% for Medicare). Fortunately, you can deduct half of this tax on Schedule 1, Line 15, and attach Schedule SE to .

Irs Schedule 2 2024 Line 6

Source : www.irs.govRoss County Volunteer Income Tax Assistance Free Tax Preparation

Source : www.unitedwayross.org1040 (2023) | Internal Revenue Service

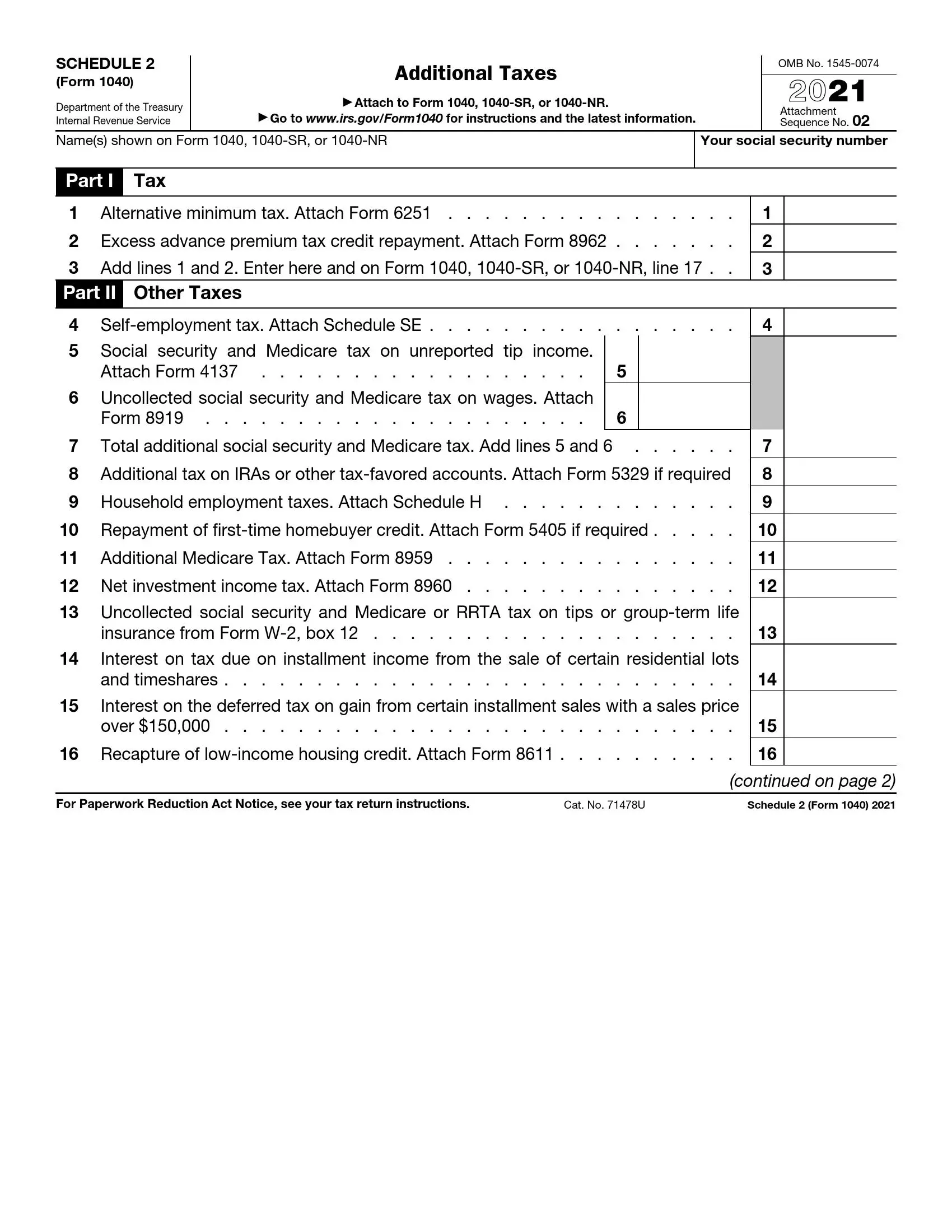

Source : www.irs.govIRS Schedule 2 Form 1040 or 1040 SR ≡ Fill Out Printable PDF Forms

Source : formspal.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040 Schedule 2 Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.com1040 (2023) | Internal Revenue Service

Source : www.irs.govFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov2023 Schedule 3 (Form 1040)

Source : www.irs.govIrs Schedule 2 2024 Line 6 1040 (2023) | Internal Revenue Service: With the start of tax season, you may be tempted to grab your W-2 form and start filing with your here’s everything you need to know about 2024’s tax season. The biggest reason to create . But there’s one line item on your pay stub that you may not be as familiar with — the OASDI tax. Check Out: What To Do If You Owe Back Taxes to the IRS Sponsored: Owe the IRS $10K or more? Schedule a .

]]>